Crypto Custodians - In Praise of the Middlemen

On crypto paradoxes, middlemen and why they are needed before they can be phased out.

A lot of people think they own their own money. They are wrong.

You might have £1,000 in a bank account, but the bank owns this on your behalf. And actually the bank only owns £100 of your £1,000 because they have lent out the rest. If everyone wants 'their' money back at the same time, the system implodes. This is called a bank-run, which we last saw globally in 2008. Similarly, lots of people think they own their own stocks and shares in an ISA or pension. But most people actually don't. An intermediary owns them on their behalf.

If I own crypto currencies in my own wallet, I actually own them. No intermediary on my behalf and nobody lending out my crypto currencies without my permission. This is exhilarating for some, but terrifying for others. My wallet does not ask for my mother's maiden name, neither does it know or care if I send my funds to the wrong address. There is no customer service hotline and no refunds when things go wrong. All it gives me is a 'private key' (series of random words, re-hashed from a 256-bit number) which acts as my unique access code. Anyone who gets hold of my private keys can access my wallet and hence MY crypto currencies... So I had better keep my private keys safe at all costs.

The problem is that I'm just not that competent. I'm careless and clumsy – I lose most things I own. This exposes paradox #1: crypto is both more safe and less safe than the status quo. It's more safe because it grants me 100% ownership and complete control of my money; eradicating all sorts of institutional bias, systemic risk and political risk. But it's also less safe because human incompetence dictates I'm more likely to lose my seed phrase than a global bank is to default and lose my savings, or a government is to seize my money.

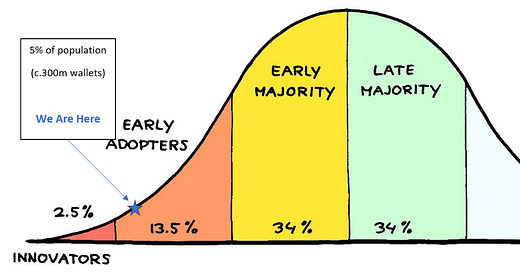

If you believe the above chart, you'll see that the risk takers, the pioneers and the morons have pushed on through and now comprise 5% of the population. But as the innovators/early adopters are absorbed into the system, the remaining 95% of the population are not going to be on-boarded as crypto users without something to reduce their risk of holding crypto.

Enter the custodians.

A custodian provides a service which stores your cryptocurrencies, or uses your cryptocurrency, on your behalf. If you believe the above adoption curve, then custodian solutions are going to be big business over the next decade. They allow crypto owners to sleep well at night. A secure, easy to use and sometimes insured solution to owning crypto (Coinbase insures up to $80k of each users’ crypto in case of any hack).

No group is this more true for than institutional investors. Now remember, these people are managing 'your money' on your behalf, so if they go in on crypto and lose your money, they are in a lot of trouble. In a survey of institutional investors who collectively manage +$100bn, "79% see asset custody as the key consideration whether to invest in this space." Not regulatory risk, not price volatility, but the actual hassle of owning crypto currencies. As Matthew Levine notes: "institutional investors want to buy economic exposure to crypto, but they find actual crypto ownership extremely unpleasant. They like that crypto prices go up; they dislike that crypto holdings keep disappearing."

So custodians are great because they mean you don't have to worry about losing your seed phrase and losing your crypto. They're also problematic because we are just back to where we started again; with someone else owning your money for you. Custodians expose paradox #2: crypto promises the eradication of middlemen (decentralisation), yet custody solutions just replace existing middlemen with new middlemen (themselves).

The reality here is that most investors like the economics of crypto but dislike its technology. This is at odds with the crypto community (builders, involved users, idealists) who care A LOT about its technology. Many in the crypto community, who are ‘decentralisation maxis’, dislike custodians and see them as a perversion of the true crypto cause. But in the long run I believe they are a huge net-positive for crypto adoption.

Bringing new users into crypto enables people to interact with a new system that at least has fewer middle-men. For example, Coinbase is the ultimate custodian on-ramp for people entering crypto. From there you are able to move your crypto to your own wallet which you own (eg Metamask) and then interact with protocols that genuinely eradicate middle-men.

One of my favourite middle-men eradicators is Enzyme Finance, which is full-on obliterating the asset manager. Enzyme are a decentralised asset management protocol which employs 0 asset managers. They allow anyone to invest directly into an operator's strategy (eg a 'yield farmer') with their real-time track record on display. In the current financial system, only professional asset managers get access to these sorts of operator strategies, meaning you and I have to give our money over to the asset manager to invest on our behalf. While I might not mind someone holding my money for me, I do mind someone being able to access opportunities that I can't, just because they happen to be 'professionals'. Protocols like Enzyme allow anyone to access these sorts of opportunities, and custodian solutions are the on-ramp that enables more people to interact with this new system.

I believe that crypto will eventually disintermediate 90% of finance 'professionals'. I believe crypto can force governments to hand more power back to the people. Ultimately I believe crypto has the potential to change the world for the better. But I do not believe all of these things will happen in the next year or even the next decade. Neither do I believe they should happen in the coming years.

Change takes time and innovation is incremental. There will be many more paradoxes exposed along the way as we try to grapple with a new system that touches every part of our lives. We are not yet ready for the full power of the crypto system to be unleashed, either as an industry (blockchains still go down and get hacked) or as a society. We should not stress about new layers of middlemen coming into the system, bringing their innovations which help on-board new users and provide a better customer experience, so long as the long-term trend continues to be fewer middle men, and access for all on equal terms.